This post brought to you by BMO Harris Bank N.A. Member FDIC. All opinions are 100% mine.

The last three posts in this My Life Journey series looked back on my milestones. Today, I’m looking forward. At my college bound kids. And I don’t have to look too far …

which freaks me out. Both emotionally … and financially.

When my son was born, the future seemed so far, far away. I was consumed with just trying keeping him alive. At the time, it felt like there was so much time …

all the time in the world to save for his future.

And then I blinked my eyes and he’s all grown up. A junior in high school. Looking at colleges.

And sometime between his birth and that blink I should have set up a college savings account for him. But I didn’t. I meant to, but it seemed like we still had so much time …

so I just kept postponing it. Rationalizing all that time in the world we had.

And then life got in the way. Living off a single income so I could stay home. Taking care of home repairs (often expensive) that needed immediate attention.

In hindsight, wish I had the foresight to establish a college fund. I didn’t. I wish I had opened a college IRA. I didn’t. And now? Well, now I’m scrambling to get ahead of my first tuition payment. Which explains the increasing number of sponsored posts here on the blog. Which explains my push to market and stock my Etsy shop. Which explains renewed emphasis on my freelance PR career.

Everything that I do – here on the blog, the Etsy shop, the freelance PR business — is 100% dedicated to my kid’s college tuition funds.

I’m determined to NOT let life get in the way!

This week’s post is a big giant slap in the face wake up call for you to do as I say, not as I do. A reminder to start saving for college the moment your child is born …

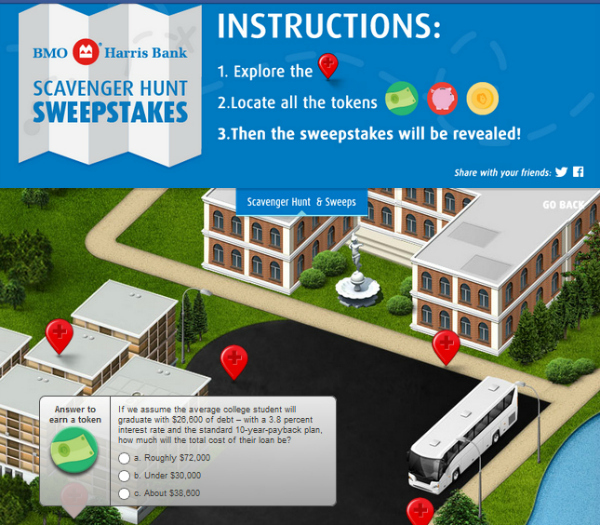

and this week’s BMO Harris Bank Scavenger Hunt Sweepstakes offers up some cold, hard facts about college.

From tuition …

to managing what your college student spends …

to college loans …

It’s pretty eye-opening.

Play along at BMO Harris Bank on Facebook and enter for a chance to win $500.

So tell me, am I the only one who let time slip by without stashing away cash for college tuition? And any helpful tips or sites I should visit for loans information and scholarships are always greatly apprecaited!!!

P.S. I’m not even going to tackle the emotional side. Let’s just say I’m suppressing those feelings, otherwise I might have a full-on panic attack!

I was lucky and had a husband who is a long-range planner. (Wait. That makes me sound like I don’t have him anymore. I still have him.) I went back to work once the kids were out of the primary grades so that I could get them both through undergrad. *sigh of relief* Financially, it’s hard. But emotionally? Let’s just say there was gin involved.

There is nothing like the feeling of not being prepared! My daughter has a way to go before we hit the college years, but I am very concerned I will not be prepared to pay for college. Yes, I have set up a savings plan, but like I said, I am concerned it will not be enough despite my efforts. Best of Luck! and try not to let that anxiety take over your world!

We have saved a little money every year from our tax returns for each of our kids since they were born. It won’t be enough, but it will get them started. I am hoping that I can use my blog too, to help pay for college. My oldest is in 8th grade, so I have a few years, but in know I’m gonna turn around and she’ll be a junior.

The Other Marian

If you would just stop blinking, maybe he won’t grow up! My second daughter is graduating from college next month. We feel like we’ll be getting a raise! haha Seriously we were like you and it all went too fast with not enough planning. So listen to Linda. Start now! Deb